import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.linear_model import LinearRegression

import statsmodels.api as sm

import statsmodels.formula.api as smf

sns.set_theme(style="whitegrid", rc={"figure.figsize": (10, 6), "axes.labelsize": 16, "xtick.labelsize": 14, "ytick.labelsize": 14})Logistic regression

Lecture 17

University of Arizona

INFO 511

Setup

Recap: Modeling Loans

What is the practical difference between a model with parallel and non-parallel lines?

What is the definition of R-squared?

Why do we choose models based on adjusted R-squared and not R-squared?

Predict interest rate…

from credit utilization and homeownership

Results: Ordinary least squares

=====================================================================

Model: OLS Adj. R-squared: 0.068

Dependent Variable: interest_rate AIC: 59859.3779

Date: 2026-02-23 11:17 BIC: 59888.2185

No. Observations: 9998 Log-Likelihood: -29926.

Df Model: 3 F-statistic: 243.7

Df Residuals: 9994 Prob (F-statistic): 1.25e-152

R-squared: 0.068 Scale: 23.309

---------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

---------------------------------------------------------------------

const 9.9250 0.1401 70.8498 0.0000 9.6504 10.1996

credit_util 5.3356 0.2074 25.7266 0.0000 4.9291 5.7421

homeownership_Mortgage 0.6956 0.1208 5.7590 0.0000 0.4588 0.9323

homeownership_Own 0.1283 0.1552 0.8266 0.4085 -0.1760 0.4326

---------------------------------------------------------------------

Omnibus: 1150.070 Durbin-Watson: 1.981

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1616.376

Skew: 0.900 Prob(JB): 0.000

Kurtosis: 3.800 Condition No.: 6

=====================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors

is correctly specified.Intercept

Results: Ordinary least squares

=====================================================================

Model: OLS Adj. R-squared: 0.068

Dependent Variable: interest_rate AIC: 59859.3779

Date: 2026-02-23 11:17 BIC: 59888.2185

No. Observations: 9998 Log-Likelihood: -29926.

Df Model: 3 F-statistic: 243.7

Df Residuals: 9994 Prob (F-statistic): 1.25e-152

R-squared: 0.068 Scale: 23.309

---------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

---------------------------------------------------------------------

const 9.9250 0.1401 70.8498 0.0000 9.6504 10.1996

credit_util 5.3356 0.2074 25.7266 0.0000 4.9291 5.7421

homeownership_Mortgage 0.6956 0.1208 5.7590 0.0000 0.4588 0.9323

homeownership_Own 0.1283 0.1552 0.8266 0.4085 -0.1760 0.4326

---------------------------------------------------------------------

Omnibus: 1150.070 Durbin-Watson: 1.981

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1616.376

Skew: 0.900 Prob(JB): 0.000

Kurtosis: 3.800 Condition No.: 6

=====================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors

is correctly specified.- Intercept: Loan applicants who rent and have 0 credit utilization are predicted to receive an interest rate of 9.93%, on average.

Slopes

Results: Ordinary least squares

=====================================================================

Model: OLS Adj. R-squared: 0.068

Dependent Variable: interest_rate AIC: 59859.3779

Date: 2026-02-23 11:17 BIC: 59888.2185

No. Observations: 9998 Log-Likelihood: -29926.

Df Model: 3 F-statistic: 243.7

Df Residuals: 9994 Prob (F-statistic): 1.25e-152

R-squared: 0.068 Scale: 23.309

---------------------------------------------------------------------

Coef. Std.Err. t P>|t| [0.025 0.975]

---------------------------------------------------------------------

const 9.9250 0.1401 70.8498 0.0000 9.6504 10.1996

credit_util 5.3356 0.2074 25.7266 0.0000 4.9291 5.7421

homeownership_Mortgage 0.6956 0.1208 5.7590 0.0000 0.4588 0.9323

homeownership_Own 0.1283 0.1552 0.8266 0.4085 -0.1760 0.4326

---------------------------------------------------------------------

Omnibus: 1150.070 Durbin-Watson: 1.981

Prob(Omnibus): 0.000 Jarque-Bera (JB): 1616.376

Skew: 0.900 Prob(JB): 0.000

Kurtosis: 3.800 Condition No.: 6

=====================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors

is correctly specified.All else held constant, for each additional percent credit utilization is higher, interest rate is predicted to be higher, on average, by 0.0534%.

All else held constant, the model predicts that loan applicants who have a mortgage for their home receive 0.696% higher interest rate than those who rent their home, on average.

All else held constant, the model predicts that loan applicants who own their home receive 0.128% higher interest rate than those who rent their home, on average.

Transformations

Predict log(interest rate)

Model

OLS Regression Results

==============================================================================

Dep. Variable: interest_rate R-squared: 0.020

Model: OLS Adj. R-squared: 0.020

Method: Least Squares F-statistic: 202.2

Date: Mon, 23 Feb 2026 Prob (F-statistic): 1.91e-45

Time: 11:17:47 Log-Likelihood: -4912.6

No. Observations: 9998 AIC: 9829.

Df Residuals: 9996 BIC: 9844.

Df Model: 1

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 2.3947 0.005 467.428 0.000 2.385 2.405

credit_checks 0.0236 0.002 14.220 0.000 0.020 0.027

==============================================================================

Omnibus: 329.756 Durbin-Watson: 2.002

Prob(Omnibus): 0.000 Jarque-Bera (JB): 152.256

Skew: -0.010 Prob(JB): 8.67e-34

Kurtosis: 2.396 Cond. No. 4.17

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.\[ \widehat{log(interest~rate)} = 2.39 + 0.0236 \times credit~checks \]

Slope

OLS Regression Results

==============================================================================

Dep. Variable: interest_rate R-squared: 0.020

Model: OLS Adj. R-squared: 0.020

Method: Least Squares F-statistic: 202.2

Date: Mon, 23 Feb 2026 Prob (F-statistic): 1.91e-45

Time: 11:17:47 Log-Likelihood: -4912.6

No. Observations: 9998 AIC: 9829.

Df Residuals: 9996 BIC: 9844.

Df Model: 1

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

const 2.3947 0.005 467.428 0.000 2.385 2.405

credit_checks 0.0236 0.002 14.220 0.000 0.020 0.027

==============================================================================

Omnibus: 329.756 Durbin-Watson: 2.002

Prob(Omnibus): 0.000 Jarque-Bera (JB): 152.256

Skew: -0.010 Prob(JB): 8.67e-34

Kurtosis: 2.396 Cond. No. 4.17

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.For each additional credit check, log of interest rate is predicted to be higher, on average, by 0.0236%.

Slope

\[ log(interest~rate_{x+1}) - log(interest~rate_{x}) = 0.0236 \]

\[ log(\frac{interest~rate_{x+1}}{interest~rate_{x}}) = 0.0236 \]

\[ e^{log(\frac{interest~rate_{x+1}}{interest~rate_{x}})} = e^{0.0236} \]

\[ \frac{interest~rate_{x+1}}{interest~rate_{x}} = 1.024 \]

For each additional credit check, interest rate is predicted to be higher, on average, by a factor of 1.024.

Logistic regression

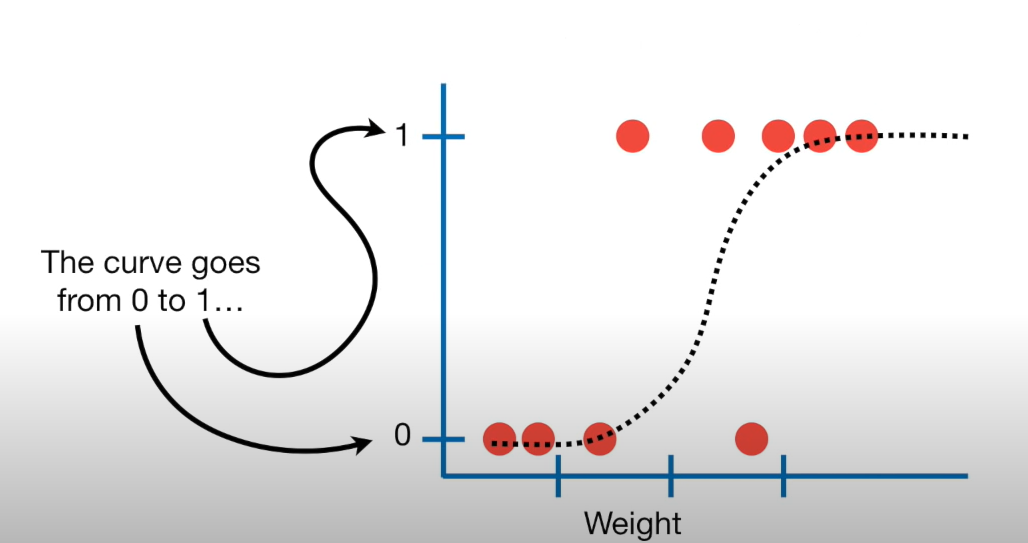

What is logistic regression?

Similar to linear regression…. but

Modeling tool when our response is categorical

Modelling binary outcomes

Variables with binary outcomes follow the Bernouilli distribution:

\(y_i \sim Bern(p)\)

\(p\): Probability of success

\(1-p\): Probability of failure

We can’t model \(y\) directly, so instead we model \(p\)

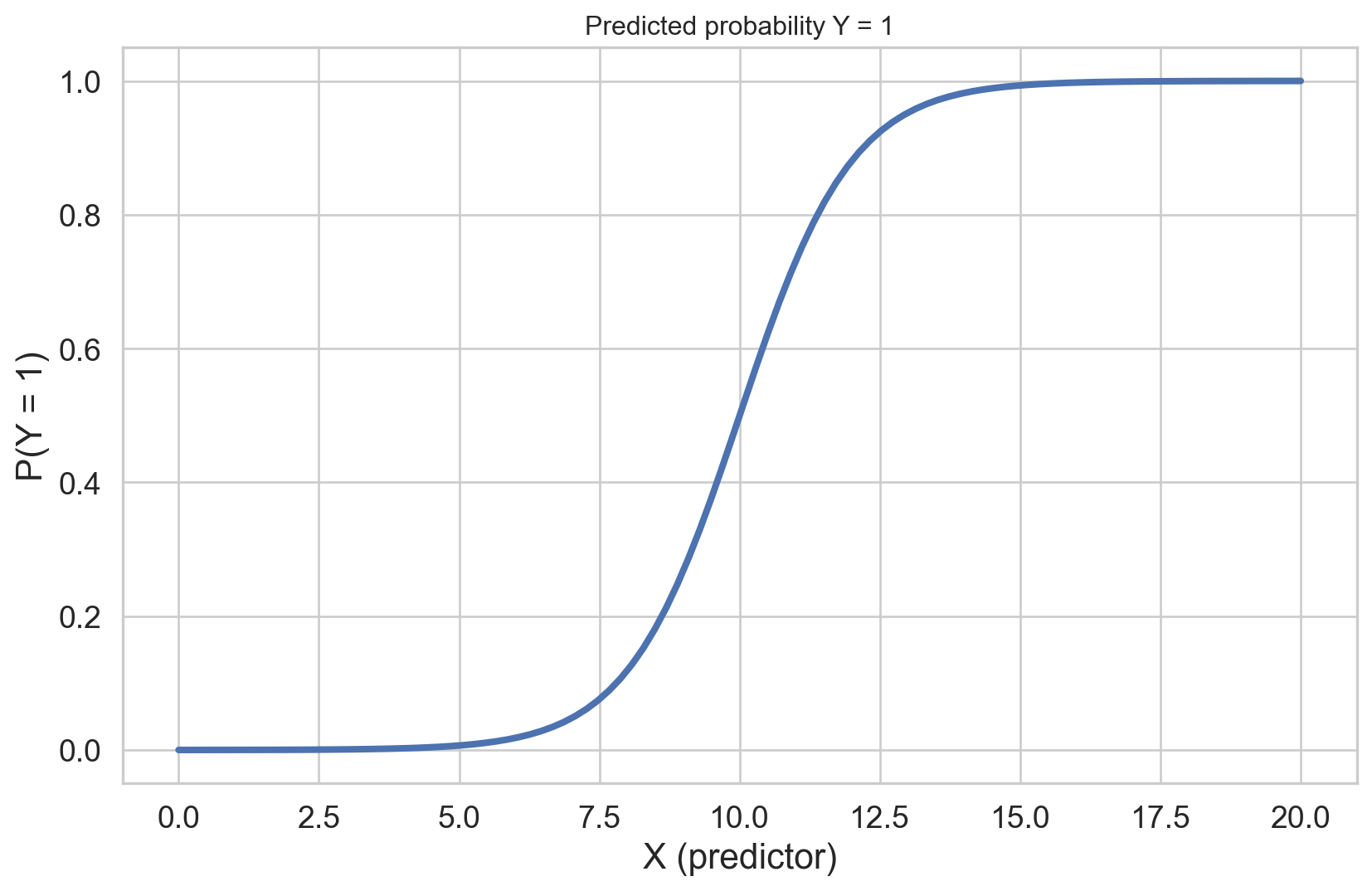

Linear model

\[ p_i = \beta_o + \beta_1 \times X_1 + \cdots + \epsilon \]

But remember that \(p\) must be between 0 and 1

We need a link function that transforms the linear model to have an appropriate range

Logit link function

The logit function take values between 0 and 1 (probabilities) and maps them to values in the range negative infinity to positive infinity:

\[ logit(p) = log \bigg( \frac{p}{1 - p} \bigg) \]

This isn’t exactly what we need though…..

Recall, the goal is to take values between -\(\infty\) and \(\infty\) and map them to probabilities.

We need the opposite of the link function… or the inverse

Taking the inverse of the logit function will map arbitrary real values back to the range [0, 1]

Generalized linear model

- We model the logit (log-odds) of \(p\) :

\[ logit(p) = log \bigg( \frac{p}{1 - p} \bigg) = \beta_o + \beta_1 \times X1_i + \cdots + \epsilon \]

- Then take the inverse to obtain the predicted \(p\):

\[ p_i = \frac{e^{\beta_o + \beta_1 \times X1_i + \cdots + \epsilon}}{1 + e^{\beta_o + \beta_1 \times X1_i + \cdots + \epsilon}} \]

A logistic model visualized

Takeaways

Generalized linear models allow us to fit models to predict non-continuous outcomes

Predicting binary outcomes requires modeling the log-odds of success, where p = probability of success